Financial planning plays a crucial role for professionals at every stage of their careers. A comprehensive financial plan facilitates obtaining both short-term and long-term objectives.

It facilitates implementing informed actions regarding savings, retirement planning, risk management, and legacy planning.

Professionals ought to take a proactive approach to financial strategy. This involves frequently reviewing their monetary position, modifying their plans as needed, and leveraging the expertise of qualified financial planners.

By mastering financial planning principles, professionals are empowered to secure a strong financial structure that enables their overall well-being.

Financial Strategies to achieve Career Success and Wealth Accumulation

Securing your financial future is paramount for long-term career satisfaction and wealth accumulation. Implement sound financial strategies early on to build a solid foundation for success. Begin by creating a comprehensive budget that records your income and expenses, highlighting areas where you can reduce spending. Allocate funds to wisely in diversified portfolios to boost your returns over time. Consider consulting a qualified financial advisor who can help you in creating a personalized financial plan tailored to your particular goals and circumstances. Periodically reassess your financial strategy and fine-tune as needed to stay on track toward achieving your economic aspirations.

- Formulate a clear financial plan that details your short-term and long-term goals.

- Build an emergency fund to address unexpected expenses.

- Seek professional development opportunities to strengthen your career prospects.

Optimize Your Finances: A Professional's Blueprint for Prosperity

Achieve financial mastery and unlock a world of abundance by following this comprehensive guide tailored for seasoned professionals. Within these pages, you'll uncover proven techniques to build lasting wealth and secure your monetary future. Start by assessing your current financial situation, identifying areas for improvement. Next, implement efficient strategies to generate wealth through strategic investments.

Master the art of budgeting by establishing a personalized plan that aligns with your aspirations. Cultivate healthy financial habits, such as consistent savings and prudent spending.

Embrace the power of alternative revenue streams to enhance your existing income and create a more resilient financial foundation. Finally, harness the expertise of trusted financial professionals to advise you on complex matters.

Building Financial Resilience as a Professional

As a professional, navigating the complexities of personal finance can be complex. With increasing lifespans and fluctuating market conditions, it's essential to develop check here a robust investment strategy that prioritizes longevity. A well-structured plan should encompass a range of asset classes, spread throughout different sectors to mitigate risk and enhance returns over the long term.

- Regularly portfolio reviews are crucial to align your investments with your evolving needs and market trends.

- Seek professional expertise from a certified financial advisor who can tailor a plan that meets your specific goals and risk tolerance.

- Stay informed about market dynamics, economic trends, and new investment possibilities to make informed decisions.

By adopting a proactive and disciplined approach to investing, you can build a solid financial foundation for a comfortable and fulfilling retirement.

Estate Planning and Tax Optimization: Crucial Factors for Professionals

Professionals often face unique obstacles when it comes to handling their capital affairs. Therefore, incorporating both tax efficiency and estate planning into their approaches is crucial. A well-structured succession plan can lower potential tax burdens while guaranteeing the smooth transfer of assets to heirs.

- Seeking with a qualified estate planning attorney and tax specialist is indispensable to create a personalized plan that addresses individual needs and goals.

- Essential considerations {include|{involves|embrace| understanding current tax laws, evaluating pertinent exemptions, and structuring asset allocation.

, Additionally, professionals should regularly review and amend their estate plan to {reflect|accommodate any changes in their life events. This forward-thinking approach can help enhance tax efficiency and guarantee a secure financial future for themselves and their loved ones.

Beyond Salary

In today's dynamic economic landscape, professionals are seeking ways to diversify their income beyond their primary salary. Cultivating multiple income streams can provide a financial cushion, enhance financial freedom, and create avenues for personal and professional growth.

- Exploring side hustles in your field of expertise can be a rewarding way to generate extra income.

- Allocating funds to assets such as real estate, stocks, or bonds can offer long-term financial returns.

- Leveraging your knowledge and skills through online courses, workshops, or consulting services can create a steady income source.

By implementing a diversified income strategy, professionals can secure their financial future and achieve greater control over their lives.

Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Andrew McCarthy Then & Now!

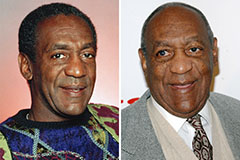

Andrew McCarthy Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!